The Role of Bronze Wing Trading in Global Trade Finance 2021

Are you looking for the best solution to take your business to the next level in 2021? Then, making use of Financial Instruments will be the right choice for you! A recent study by WTO states that nearly 80-90% of the world depends on Trade Finance for their businesses. Also, it has been predicted that this ratio will get the increase by this year; as many banks are under recession and they were unable to help their clients with their Trade Finance needs. In this blog, we have explained the role of Bronze Wing Trading in providing the best solution in Global Trade Finance.

Importance of Global Trade Finances

As per the recent study, almost 90% of the world economy is filled by SMEs. But SMEs face a lot of challenges when it comes to obtaining the Trade Finance; they require for expanding their business overseas. Mostly, banks won’t finance SMEs without enough security or without blocking their funds. As a result, in most cases, SMEs’ working capital can’t be able to tie in a next deal; until the first shipment arrives.

Get LC, SBLC & BG at ZERO Collateral – Apply Now!

Here comes the importance of Trade Finance Solutions! This represents a range of Financial Instruments used by traders to secure their deals from risks; also to conclude their deals without facing cash flow issues.

How We Can Help You With Global Trade Finances?

If a buyer or seller, contacts us with their Trade Finance needs; we will do a complete study on their deal. Then, we will advise the best appropriate solution to meet their business needs.

Being the Trade Finance Provider in Dubai, we help them by providing Financial Instruments such as – Letter of Credit, SBLC, or Bank Guarantees that suits their business needs.

Get collateral-free Trade Finance from Us – Contact Us Now!

Unlike banks and some of our competitors, we were not tied with any brokers or other Financial Institutions to facilitate Trade Finance for our clients. Rather, we have our own bank facilities with Good Repute Banks, which makes us the Direct Providers of Bank Instruments.

Also, we work around the clock to conclude the deal within 48hrs. Once the client pays the service charges, we will start work on their transaction. Also, we will provide the Financial Instrument draft copy for their reference. And then, after their approval of the draft; we will instruct our bank to issue the required facility from our Bank Account in favor of their counterparty.

Get Trade Finance for Your Imports & Exports

To be in short, Global trades wouldn’t be possible without the need for Trade Finance. We, Bronze Wing Trading, the Financial Instruments providers in Dubai understand the importance of global trade finance. We support the needy traders by providing – LC at Sight, SBLC MT760, and different types of Bank Guarantees. All our Trade Finance products help traders to reduce the trading risks involved. Also, it helps to enhance more cross-border trade.

To get Bank Instruments from us, you can submit your request to us by filling out the Online Form or sending us via email! We will study your deal and get back to you with a FREE Quote ASAP.

Trade Finance Services Available for Importers and Exporters

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

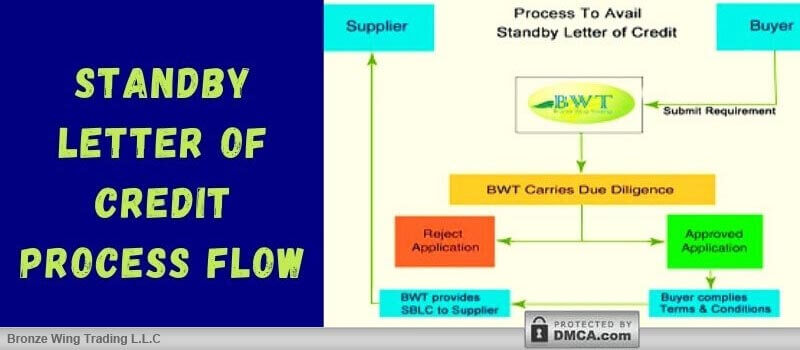

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]