Bid Bond

How to Get Bid Bond

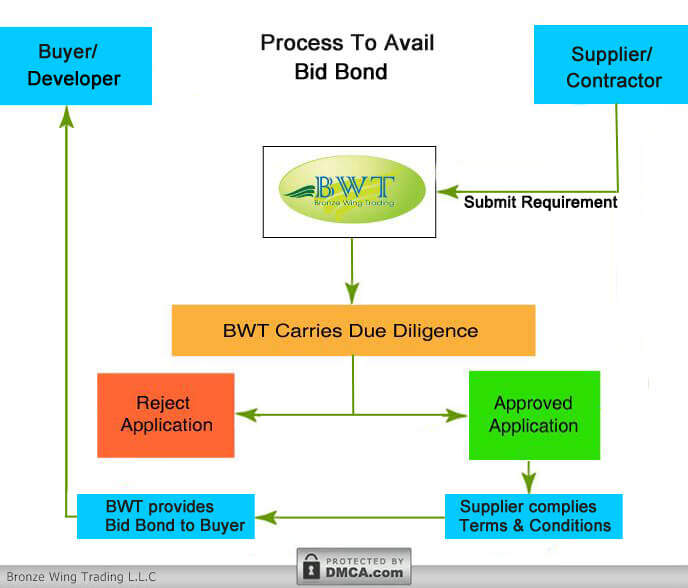

- Submit your Bond Guarantee request to us in terms of contract copy or tender documents.

- Next, we will analyze the contract between you and your counterparty. Further, if you’re eligible to proceed further, we will approve your request; also, will ask you to sign the service agreement & to pay the admin charges.

- Once the agreement is signed and the charges are paid, we will structure your guarantee with our bank by blocking our bank limit.

- After that, we will send the Bond Draft for your approval; also will inform you the charges of BG Issuance.

- Finally, once the draft is approved and the charges are paid, we will instruct our bank to issue the Tender Guarantee to the counter party’s bank account via SWIFT MT760. Accordingly, our bank will issue the MT760 SWIFT within 48hrs.

Apply For Bid Bonds

Get a FREE Quote from us within 24 hours

Bid Bonds Video

Latest Transaction

Bid Bond Issued to a South African Developer

A Construction Firm approached Bronze Wing Trading for a Bid Bond Guarantee to enter into the bidding contest floated by a developer in South Africa. We facilitated the 10% Bid Bond in favor of the developer by blocking our bank limit available with European Bank. With this MT760, the contractor won the bidding contest & signed the building project.

What is a Bid Bond Guarantee?

A Bid Bond Guarantee is also called a Tender Bonds or Tender Bid. It’s a written undertaking issued by a bank on behalf of contractors and suppliers who are going to submit their tenders. That is to say that this Guarantee assures that the winning bidder will honor the terms of the bids and will undertake the project as agreed in the bidding contract; if awarded with a bid.

When project owner floats a tender, they will receive a bid bond from a contractor as a part of the bidding process. This is to guarantee that they will honor the terms of the contract which they bid. Also, this ensures compensation to the project owner; in case, if the winning bidder fails to start work on the project. Further, these types of bonds are often used in construction or other projects that follow the same kind of tender process.

Tender Bonds are a kind of construction bond that helps to safeguard the owner in a bidding process. As a contractor or seller, having construction bonds enhances your chance of winning the bid on a larger project. Also, it not only gives the commitment to complete the project on time; but also assures that a contractor has enough funds available to execute the project. If you’re in construction and are going to submit your tender proposal for a larger project; submit your tender quote along with Tender Guarantee; and so, become pre-qualified to enter into the bidding contest.

How Does a Bid Bond Work?

Usually, when a contractor or a supplier is about to submit their bids for a contract or trade deal, the counterparty will demand a seller to provide a guarantee upon tender submission. Further, this guarantee assures that the bidder will comply with the terms of the bids. Also, it ensures that in case, if the winning bidder fails to enter into the contract or didn’t perform as agreed; then the counterparty can claim the bond to get the compensation.

Tender Bonds not only assure that the contractor will honor the terms of the bid but also, assures the project owners to claim the bid bond as compensation, in case of any default in embarking on the project, as per the bidding terms.

Moreover, these bonds are issued when you submit your tender. Also, it remains in force for the term needed by your buyer or developer. In case, if you fail to win the tender, then, the developer or buyer will return the bonds. But, if you win the tender; you will sign the contract with the project owner or buyer. After then, you need to provide a performance guarantee in favor of the owners. Once the PG MT760 is issued, the project owners or buyers will return the bid bonds, or else, it will be considered null & void.

Do You Need Tender Bonds?

Yes! Bid Bonds play a vital role in bidding for a building project or trade contract. In case, if you submit a tender without being backed by a bond, it will not be accepted. This is because Bid Bonds serves as a guarantee for project owners to hire a contractor who is qualified to execute the work as per the bidding terms. In bond issuance, as Banks stands as a guarantor, it will perform a thorough background check before issuing any contract bonds. They will check the contractor’s credit score, credit worth, & past project history in terms of completion of work. In case, if they are unsure whether you as a bidder can actually perform the job; then they will not issue the bid bond; as it creates a huge risk for them, in case of any claim arise.

Since the banks perform thorough checks before issuing the MT760, project owners can easily trust the contractors who can provide Bonds. Indeed, this is the reason why they demand Tender Bonds as a Guarantee from bidders who submit their tender for a project or trade deal. Besides, having this guarantee in hand makes your bids more appealing & accurate; hereby increases the chance of winning the contract.

So, if you want to get hold of valuable contracts from buyers or project owners, then, it is a must to secure this guarantee in their favor. To get this MT760 Guarantee, Contact Us Now! Contact Us Now!

Parties Involved in Bank Guarantee

1. Supplier / Contractor

Who requests their bank to issue a tender guarantee in favor of their counter parties to get qualified in a tender.

2. Buyer / Developer

Who demands & receives Tender Bonds from a seller or contractor.

3. Bank

The one who issues the tender guarantee on behalf of the contractor or seller and in favor of the project owner/ buyer. Also, it assures the parties that the contractor or seller can perform the job; if they win the tender.

Types of Bid Bond

1. Conditional:

The beneficiary can call the bonds only if the T&Cs met as stated in the tender bond.

2. UnConditional:

The beneficiary can call the bonds at any time, in case if the contractor or seller is in default.

Purpose of Bid Bonds

Availing Bid Bonds for bidding contracts not only helps you to win worthy contracts. But, it also provides you with the benefits listed below:-

- Solve trust issues between the parties involved in the trade.

- Can reduce fiscal risks.

- Also, it assures the project owner or buyer that the contractor or seller will comply with the terms of the contract. That is if the tender is awarded.

- Gives assurance from the bidder who signs the deal.

- Also, ensures that the contractor submits a precise quote under the tender process.

How Much Does Bid Bonds Cost?

The bond cost consists of the bank commission fee, processing fee, swift charges, and also other handling fees. Further, if you want to qualify for your tender, please fill out our online application. Hereby, our team will study your contract & will approve your request for the issuance of Tender Bond in just 24hrs!

Apply for Tender Bond Guarantee!

Want to secure worthy contracts from the global market by contesting on a bid? But not sure where to start? We are here to help you by extending our bank facilities on behalf of traders and contractors. As the Surety Bond Providers in Dubai, Bronze Wing Trading assists startups and medium sized contractors to get the bond quickly issued without blocking their cash funds. With a simple & easy process, we have a successful track record of helping contractors with low credit scores to qualify for surety bond issuance.

Bronze Wing Trading is a direct provider of different types of Bank Guarantees from rated Banks in Europe. Since we have our own credit lines; we can provide the required guarantee from our rated bank accounts within 48 hours.

Submit your Bid Bonds – Tender Bonds Bid Bond – Tender Bond requests to us now!