What is Tender Bond in Construction?

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail!

Is your developer/project owner floating a bid for the construction of a high-rise building? Are you going to participate in a bidding process? Increase your chance of winning the bid by submitting your tender along with Bid Bonds – Tender Bond/Guarantee.

In the construction industry, Tender Bonds act as a guarantee to assure the project owner; that the winning bidder will honor the terms of the bid; also, will undertake the project as per the agreed terms. Further, it assures the project owner that the contractor is fiscally stable; also, has the required resources to take on a project, if awarded.

Bid Bonds are issued by banks on behalf of their clients and in favor of the project owners. Since the bank stands as a guarantor for the contractor’s bid, the owners are more likely willing to work with contractors; who can provide a Bid Bond along with their tender documents.

How do Tender Bond Work?

When a developer floats a bid for a building project, they will receive tender bids from 100s of contractors who submit inapt and lower bids to win a contract. On the other hand, developers would also have no other way of assuring that the selected contractor; would be able to complete the project as per the quoted bid.

Get Tender Bond without Blocking Your Cash Funds – Apply Now!

Here comes the importance of submitting the bid along with the Bid Guarantee. This assures the project owner that the winning contractor will complete the project at the agreed price. And also, it assures that in case if the contractor tries to raise the quote after entering into the contract; the project owner can claim the bond.

Further, submitting the quote with a Tender Guarantee will also help contractors to acquire other bonds such as performance bonds and advance payment bonds; if required.

How to Apply Bid Bond – Tender Guarantee?

To get a Bid Bond, contractors or sellers can contact their bank with their MT760 request. In this case, the bank will demand a certain percent of the bond value; as collateral to proceed further. Once the bank receives the collateral and other related documents; they will start working on the bond request; and will issue the required MT760. In case, if the contractor or seller can’t able to provide the collateral; then the bank will decline the request and mark them as not eligible to get the BG MT760.

But in that unforeseen situation, Bronze Wing Trading will come as a helping hand! With the use of our own credit lines; we can issue the required bond from our Bank Account without blocking your cash funds.

Do you require Bid Bond to submit your tender? Is your bank declined your MT760 request; as you didn’t meet the banking terms? Contact us today!

Apply for Bid Bond – Tender Bond now and increase your chance of winning the contract!

Submit Your Tender with Tender Bond Guarantee

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

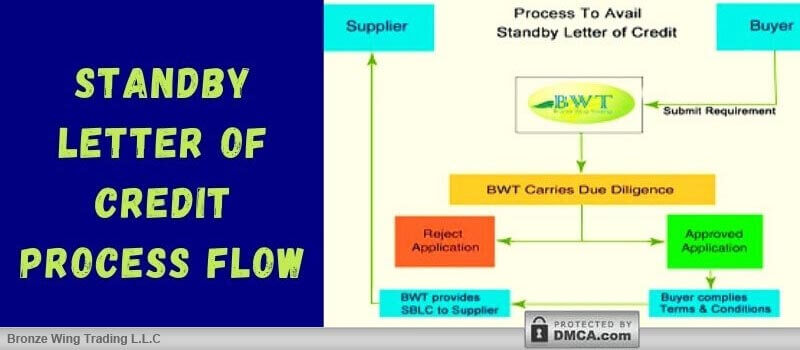

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]