How Does Trade Finance Work for Importers and Exporters?

Expanding business means finding new clients & gaining profits. It seems to be easy to earn profits by doing global trade. Even though, today’s market seems to be planned; there are a few risks involved. That’s why Trade Finance Providers have come up with the solution to help traders to secure their trade from risks and to improve the cash flow.

What is Trade Finance?

Trade Finance states financing for both domestic and global transactions. This term act as an umbrella term that covers a complete solution. Also, it includes -Letter of Credit, SBLC MT760, Bank Guarantee MT760, and Performance Bond Guarantee. Also, Advance Payment Bond, Bank Comfort Letter, and Bid Bond / Tender Bond.

Submit Your Trade Finances Requirements – Click Here!

When it comes to the trade market, a seller would expect upfront from the buyer for the goods that are to be shipped. On the other hand, the buyer wouldn’t want to release the payment; prior to receiving the full consignment of goods. This is where the bank steps in to give assurance to both parties by providing Financial Instruments.

By keeping the Bank as a Guarantor for trade dealings, the buyer will be assured that they will receive the product as per the signed contract. On the other hand, the seller will be assured that they will receive the payment for the shipped goods within a set time period.

How Does Trade Finance Work?

The main role of Trade Finance is to introduce a 3rd party between the deal to reduce payment and supply risk. And this is different than conventional financing. Conventional financing solely manages a lack of cash funds. But, Trade Finance may not point out the buyer’s liquidity or creditworthiness. Rather, Trade Finance protects traders against risks associated with – shipment, politics, currency fluxes, etc. Also, Trade Finance facilities offer a complete solution to secure trade from risks related to it. Besides reducing risks; it also works to improve cash flow and conclude deals without blocking working capital.

Get a FREE Quote for Trade Finance – Apply Now!

Benefits for Importers

- Reduces the risks related to global trading

- Grow your business and improve cash flow

- Builds trust between trading partners

- Receive your goods / services without having to pay upfront

Benefits for Exporters

- Reduce the payment risk for the shipped goods

- Gives peace of mind ensuring secure trade transactions.

- Enter into deals without waiting for the actual cash to arrive

- Receive credit lines for purchasing goods and services

Identified a growing market for your product overseas, but don’t have the funds to conclude the deal? Or need to manage global trading risks and improve cash flow? Now you can get things moving, even if you don’t have enough funds in your account. Contact Bronze Wing Trading L.L.C., the leading Trade Finance Provider in Dubai.

We can help you with a wide range of services designed for those who deal with global sellers / buyers. We can provide Bank Instruments from rated banks on behalf of your company without availing cash margins from your end.

Start importing goods from overseas by availing Financial Instruments and make your trading business more profitable.

Do You Require Our Trade Finance Services?

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

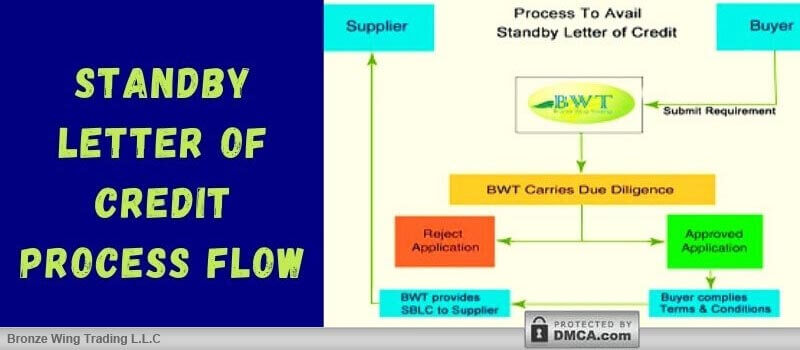

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]