How to Import Goods from China Using Letter of Credit?

Usually, North China exports industrial goods such as machinery parts, equipment, etc. and East & Central China exports all kinds of commodities & South China export hi-tech products and fashion accessories. From machinery parts to fashion accessories, China stays as the top destination to import goods at the best prices.

You want to import goods from China, but don’t know how to start with your imports & the payment terms used? Bronze Wing Trading, the Letter of Credit Providers in Dubai has provided complete information on – The Most Common Payment preferred by Chinese vendors & the easy way to import goods using LC at Sight without making an upfront payment to your supplier.

Methods of Payment Used to Import Goods from China

In China, there are many ways to finance imports and the most common is – Letter of Credit and Documentary Collection. Among these two, Letters of Credit has mostly preferred by suppliers as it gives complete payment protection.

Using Letters of Credit is not only beneficial for the suppliers; but also, for importers. Usually, in China, the seller starts shipping goods on the basis of 30% advance & 70% upon shipment. So, to purchase goods from a Chinese supplier, you need to be ready to provide 30% of the total value as advance payment. But, in case, if you don’t have enough cash funds to pay as advance means; you can choose LC at Sight as your payment term. This ensures your supplier that they will receive the payment, once they submit the shipping documents to the bank as stated in the issued Letter of Credit.

Since the Letter of Credit gives the payment assurance to the supplier before the supply of goods, sellers are ready to supply the required goods as per the agreed contract without getting any advance.

Open Letter of Credit at ZERO Cash Margin- Click Here

How to Get Letter of Credit to Import Goods from Overseas

If you’re going to buy goods using an LC at Sight as a payment term; then you can get help from banks to open LC MT700 on your behalf. When you contact your bank to open the MT700; they will demand you to provide a 100% cash margin as collateral. If you are ready to provide the cash margin, then the bank will start working on your request. Further, it would take 2-3 days to get your request approved & then the bank will issue the Letter of Credit in favor of your seller. Normally, it will take nearly 5-6 days for the Letter of Credit issuance.

In case, if you don’t have enough cash funds to block in your bank account as a cash margin; then the bank will decline your request. We, the Letter of Credit Providers in Dubai understand the cash flow issues faced by buyers. So, to assist you with your deal, we provide a DLC at Sight from European Banks in just 48hrs. Unlike banks, we will not take days or weeks to get your Letter of Credit request approved & issued. Once you submit your request, we will analyze your deal & approve your request within a day & get the LC issued within the very next day subject to the payment of LC charges.

So, what are you waiting for? Contact us now to get a Letter of Credit from European Banks to import goods from China.

Import Goods from China Using LC at Sight

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

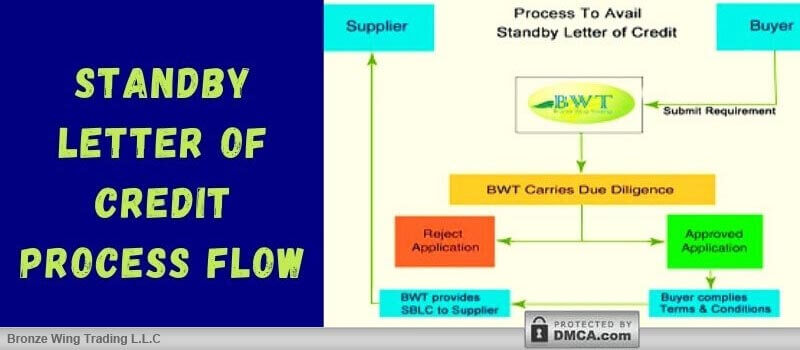

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]