Methods of Payment in International Trade: Letter of Credit

One of the best methods of payment in international trade is a Letter of Credit. As it gives assurance to both buyers & sellers, this payment term is mostly preferred in trade transactions.

While dealing with imports & exports, the most vital thing that the traders often worried about – Payment Terms. Unlike local trade deals, doing trade with traders who are sitting miles away may create worries about the terms of payments. That is – buyers may not want to release their payments prior to the shipment, since, they don’t know whether the seller is readily available with the goods to supply or not.

On the other hand, the seller doesn’t want to ship the goods without advance payment. Because they may not know the creditworthiness of the buyer. So, for all buyers and sellers, it is a must to be aware of the Methods of Payment in International Trade available in the market.

Methods of Payment in International Trade

Choosing the right payment term plays an important role while doing international trade. There are a wide range of payment term available for importers who wish to do overseas trade dealings without fiscal risks. Mostly, traders who do import and export mainly rely on Trade Finance such as – Letter of Credit, Documentary Credit, LC at Sight, MT700, Standby LC, Bank Guarantee; also, Performance Bond, Comfort Letter & Advance Payment Bond.

Among all these Financial Instruments, the most common payment term used in global trade is – Letter of Credit. MT700 is used by buyers to give assurance to the sellers that the payment will be made once the goods are shipped. And this helps buyers import goods from overseas without paying upfront to their sellers.

Get FREE Quote for Your Letter of Credit Requirements – Click here

What is DLC MT700?

Letter of Credit is the most secure financial tool available for global traders. LC MT700 is the written commitment issued by a bank on behalf of buyers and in favor of sellers. It acts as a guarantee; also, it ensures the seller that they will receive the payment; once they met the terms and conditions as stated in the issued MT700.

Also, an LC at Sight protects the buyer, since no obligation arises; unless and until the goods reached the buyer’s port, as per the signed contract. The buyer needs to arrange the LC based on the sales contract of their trade deals. It can issue for one-time transactions between the seller and buyer or used for an ongoing series of trade deals.

Letter of Credit – The Best Methods of Payment in International Trade

Do you know why a Letter of Credit is called the best method of payment in global trade? This is because it gives assurance to both buyers and sellers in terms of performance & payment. The seller assured that they will receive the payment; once they submit the documents (as stated in the issued LC) to the buyer’s bank.

Once the documents are submitted, the bank will verify it & if it complies with the LC terms, then they will release the payment to the supplier. Since the bank is a guarantor, suppliers always agree to use LC Payment for imports and exports.

Importers prefer to use MT700, as it helps them to import goods from their supplier without paying upfront. Also, having LC gives them the confidence to deal with unknown suppliers without facing any risks.

Letter of Credit at ZERO Collateral – Apply Now

How to Open Letters of Credit?

Since Letters of Credit provide real benefits, the banks are seeing the growing demand for Letter of Credit requests from buyers. To avail such LC MT700 from the banks for trade; the buyer needs to deposit a certain margin value, or to provide it as collateral. But in certain cases, buyers who don’t have cash funds in their hands; may not be able to avail Letter of Credit from their bank to conclude their import deals.

If you’re the one who requires a Letter of Credit but facing a lack of cash funds to meet the bank’s demands; contact us today! Bronze Wing Trading L.L.C., the Letter of Credit Providers in Dubai assists traders to avail LC MT700 from rated banks without availing cash margin.

Contact us today to avail Letter of Credit, LC at Sight, MT700 within 2 working days!

Looking to Avail DLC MT700 without Pledging Cash Margin?

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

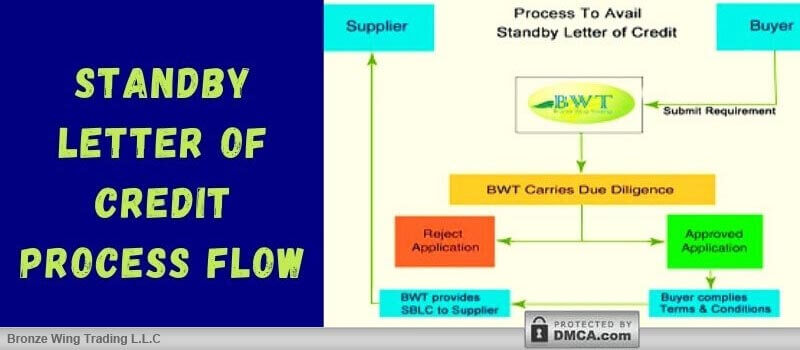

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]