What Makes Bronze Wing Trading, the Best Trade Finance Company?

Bronze Wing Trading is rated as the trusted & genuine trade finance company in Dubai with 30+ years of experience and more than 25,000 successful clients, globally.

As a trader, you need to choose the right provider who supports you with your deals in terms of financing. In today’s economy, trade finances play a major role by enhancing global and local import & export deals. Nowadays, many traders are interested in taking the benefits of financial support to conclude their deals on time. But, they don’t know where to turn when looking for the right trade finance company. Read this blog to find how to find the right service provider to get the support you require.

As a business owner, you don’t want to put your entire business at risk by working with just any so-called finance provider. So, you need to do research to know more about the company before choosing the one. Failing to do so will end up causing risks to your business; as well as your counterparties. Here we are going to explain – what are the factors you need to look up when choosing a Trade Finance Provider. Also, we will explain what makes Bronze Wing Trading, the best Bank Instrument provider.

Choosing the Best Trade Financing Company

First, you need to find a company that is registered. If not registered; or that doesn’t have its own corporate information readily available for you to view, then is not your option. Choose a reliable one who has all the info available on their website for users to preview. You need to choose the provider who can help you by providing the right Bank Instrument from a genuine bank.

Discuss Your Trade Finance Request with Us – Click Here

Next, look for experience & expertise. You need to find a team of experts who are well versed in import-export finances also they need to help you to structure your deal and get the job done at the right time.

Read the past success of the company. If the company has a long list of clientele; then they will have sound knowledge to assist traders; to overcome the cash flow obstacles. Also, they can ensure the clients that they will provide the right Trade Finance support; to conclude their deal on time.

Bronze Wing Trading – Trade Finance Company in Dubai

When considering above all factors, Bronze Wing, well-known as one of the best Financial Service Providers in Dubai. We maintain a user-friendly website with all our info updated; which helps users to know about us.

Next, when it comes to experience, we are in this finance industry for over 3 decades. Further, we work with a team of finance experts who structure the clients’ trade deals in an effective manner.

When it comes to the issuance of Bank Instruments, we have our own credit lines available with Good Repute Banks. And this helps us to assist our clients with their trade finance needs in just 48hrs. To date, we have assisted more than 25,000 clients & maintain a proven track record of issuing Bank Instruments such as Letters of Credit, SBLC MT760, BG MT760 for clients globally. We have listed our success in assisting our clients on our website under the tab “Bronze Wing Trading Success Stories”.

Compared to banks & other providers, we follow a very simple & easy to use process with less approval period of less than 48hrs.

Hope now you are aware of how we stand out from our competitors as the best Trade Financing Provider.

To know more about us & our trade finance services, you can contact us at any time!

Get Trade Finance Support from Us!

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

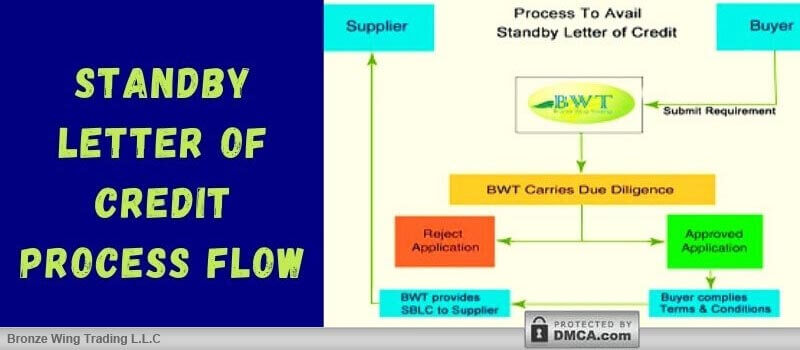

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]