What Is The Procedure For Applying Trade Finance Facilities?

Have a million dollars worth of deal pending in your hand? Can’t be able to precede the deal due to lack of cash flow? Most traders don’t always have a million dollars sitting in their bank account, as they utilized it to manage other core businesses. So, to carry out their transaction and to secure their deal, they used to get help from trade finance facilities.

Trade Finance Facilities – Definition

It acts as a complete solution that includes a wide range of financial tools that helps buyers and sellers to conclude their transaction faster and even secure. The instruments mostly include LC MT700, Standby Letter of Credit, Bank Guarantee, Bank Comfort Letter, Bid Bond, Advance Payment Guarantee, and Performance Bond Guarantee.

All the Financial Instruments are crafted to meet the needs and demands of the traders. By availing Bank Instruments from us, no need to worry about the lack of cash funds or lack of credit lines.

Collateral-Free Trade Finance Facilities – Apply Now!

So now, the question that arises is “How to Avail Financial Help from BWT?” Here we have come up with the simple step-by-step process to avail financial instruments from us without collateral. Let us assume that you’re in need of an LC MT700 to secure your transaction. Follow the below steps to avail Letter of Credit MT700 from us.

Letter of Credit Process

Step 1: Submit your requirement to us in the form of a proforma invoice or a Sales Agreement or Contractual Agreement.

Step 2: Next, we will analyze the deal between you and the seller. We will review your deal based on a few criteria and let you know whether we approved your LC request or not.

Step 3: If approved, we will sign a service agreement with you. Along with this, we will also let you know about the admin charges to start work on the transaction.

Step 4: Once you sign the agreement and pay the admin fee, we will start working on your transaction. And we will send the LC or DLC draft for your review. Then, you need to check the LC draft to find whether it complies with all the terms or not. If so, you need to provide your approval by sending the signed draft.

Step 5: After receiving the signed draft, company documents, and LC issuance fee; we will request the bank to release the LC. Our bank issues the LC on behalf of the buyer, i.e. you, and in favor of the seller via Swift MT700.

With the issued LC, now you’re ready to avail your million dollars worth of goods without the worry of cash flow. The same LC Process applies for availing other financial tools whether it’s SBLC MT760 or Bank Guarantee.

Grow your business by availing Trade Finance from rated Banks without investing your cash funds. Our services are customized to mitigate risks, reduce financial hurdles & improve cash flow; also, to assist you to earn handsome profits.

Avail Our Trade Finance Services to Grow Your Business

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

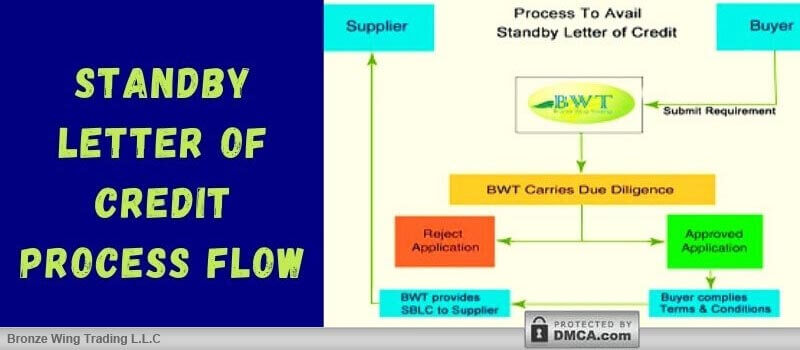

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]