Types of Bank Guarantees and Its Definition

What Are Bank Guarantees? A BG MT760 is an assurance between the buyer and the seller. This assures that if the buyer fails to oblige the payment terms; then they need to make the payments on their behalf. There are different types of Bank Guarantees available for traders and contractors.

Guarantee Letters are used in bulk trade dealings such as – purchasing equipment, heavy machinery, raw materials or to get funds to run businesses and so on. Further, to facilitate all these deals, the Banks act as a guarantor that the payment will be made on time; and if not, they will oblige to pay on behalf of their client.

When traders from overseas do trade with each other, both buyers and sellers look for some kind of assurance that holds the transaction together. And this trust is easier to maintain if a third party is willing to guarantee the other parties’ liability. Usually, sectors are ready to offer different types of Bank Guarantees for traders to facilitate global trade deals.

Get BG MT760 at ZERO Collateral – Apply Now!

Types of Bank Guarantees

Performance Bank Guarantee

Performance Bond is a written commitment issued on behalf of contractors; to assure the positive completion of the project or the supply of goods or projects. Under this Letter of Guarantee, the banks will give the assurance and pay the compensation, if the goods and services are not delivered on time, as promised in the agreed contract.

Bid Bond Guarantee

Mainly used in construction, Bid Bond helps contractors to win the bidding contest by giving assurance that they will complete the project as quoted in the bid. Since this gives the needed assurance to project owners. This is the reason why nowadays, contractors provide Bid Bond while submitting their bids for the tender. By doing so, it increases their chance of winning the bid. Also, allows them to secure contracts. In the same way, the seller can also avail this bond to ensure that they will supply the goods; as per the quoted price, if they won the bid.

Advance Bank Guarantee

Advance Payment Bond issued on behalf of its client, upon request, when the seller requires advance payment from the buyer. If the seller defaults to supply the goods or fails to perform the tasks mentioned in the contract; then the buyer has the right to call the bond; to claim the full or partial payment made to the seller.

Payment Guarantee

Deferred Payment Guarantee acts as an assurance for payment usually made in installments, i.e. overdue or delayed. This type of bond issued for the purchase of heavy machinery and bulk goods.

To Submit your APG/PG Requirements to us, – Click Here!

How to Get Types of Bank Guarantees On Your Behalf?

Getting a Guarantee Letter on your behalf is not an easy task. Before issuing MT760, usually, banks will undergo a study; to verify whether their clients are eligible to avail MT760 or not.

To issue MT760 on your behalf, they may have certain criteria. Also, it includes a certain percent of the project value as cash margin or third party assurance. If you didn’t fall under these terms; then the bank will decline your request.

So, to help you to secure contracts and worthy deals, Bronze Wing Trading L.L.C., the Bank Guarantee Provider in Dubai assists traders and contractors to avail BG MT760 without blocking cash funds.

So, why are you waiting for? Send your BG request to us. We will study your request & will get back to you with a FREE Quote in 24hrs. To issue the BG MT760 on behalf of your company at ZERO Collateral, we will extend our credit lines & will block our own cash funds on behalf of your company & get the BG issued in 2 days.

Open Up New Business Opportunities with Bank Guarantees!

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

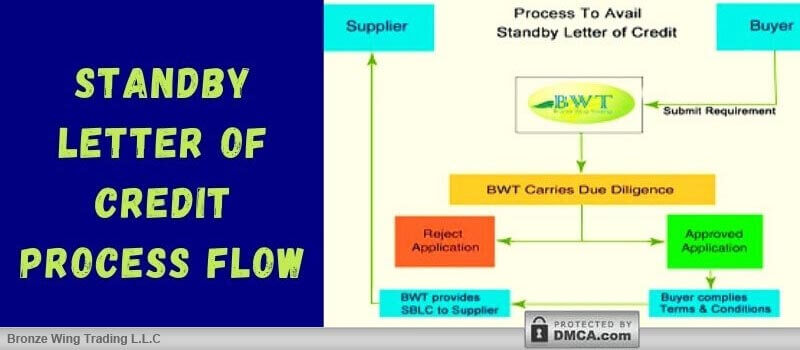

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]