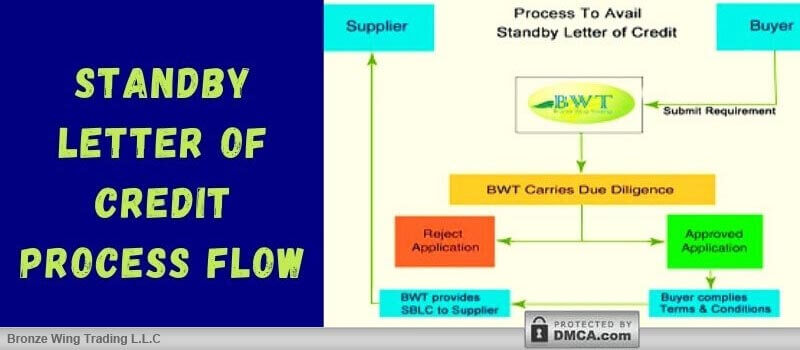

Understand the Standby Letter of Credit Process Flow

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller.

What is a Standby Letter of Credit?

Standby Letters of Credit or SBLC MT760 is the written undertaking issued by a bank where it guarantees the payment of a specific amount of money to a seller, in case of buyer’s default in complying with the payment terms. By using SBLC, the buyer is certain to receive the goods and the seller is assured of receiving payment. This is because, as per the SBLC, the seller will receive the payment, only if they supply the goods as per the agreed contract.

Get SBLC at ZERO Collateral – Apply Now!

Standby Letter of Credit Process Flow

By giving payment assurance to the seller, SBLC opens up new opportunities for buyers in the global trade market. For example – A Buyer makes a deal with a vendor to ship 10,000 MT of Rice on a credit basis. The seller wants to protect their company against the buyer’s default in making the payment & ask him to get a Standby LC as a part of their agreement.

Once the buyer provides the SBLC MT760 in favor of their seller, the seller is ready to supply the goods on a credit basis. Because they get the payment assurance from the bank, as the Standby LC states that in case of buyer’s default in making the payment, the bank is responsible to fulfill the payment commitments.

So in case, if the buyer fails to meet their financial obligation, the vendor will submit the SBLC to the buyer’s bank to collect the payment. Further, the buyer’s bank then pays the vendor and the buyer will have to repay his bank.

How to Apply for SBLC?

Are you in need of SBLCs to import goods on a credit basis? Then, you can get help from your bank directly, if you have an excellent credit record and enough cash funds to give as collateral. And then, the bank will issue the MT760 based on your trade deal info. Once the seller’s bank receives the MT760, they will advise the SBLC to the seller. Further, the seller will review the MT760 and will start the shipment as per the agreed goods.

Easy Application Process to Get SBLC – Apply Now!

But what if, if you don’t have enough cash funds & you don’t have a good credit score? Then how you will get the MT760 from Good Repute Banks? No worries! In such a scenario, you can get help from SBLC Providers in Dubai. We can provide the required SBLCs from well-rated banks at ZERO Collateral in 2 working days. Our SBLC Process Flow is as follows:-

- Submit your Standby LC requirements to us.

- We will analyze your SBLC request & will approve if it complies with our terms.

- You need to sign the service agreement & pay the admin charges to initiate your SBLC transaction.

- We will structure your SBLC with our Bank & will send the MT760 draft for your review.

- After the MT760 draft approval & issuance fee charges receipt, we will instruct our bank to issue the required Standby LC from our bank account to the seller’s bank account via SWIFT MT760.

Compared to banks & other trade finance providers, our process is very simple & straightforward. Discuss your SBLC requirement with us now & start importing goods on a credit basis.

SBLC to Import Goods on a Credit Basis

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]

Usually, North China exports industrial goods such as machinery parts, equipment, etc. and East & Central China exports all kinds of commodities & South China export hi-tech products and fashion accessories. From machinery parts to fashion accessories, China stays as the top destination to import goods at the best prices. You want to import goods […]