What is Import Finance Facility for Trade & How Does It Work?

What is Import Finance? Import Finance Facility plays a vital role to assist traders to do trade dealings in a safe and secure way without facing financial issues. Trade Finance bridge the trust issues between two parties who are doing global trade by sitting in two different countries. Making use of Import Finance can make cross-border trade easier and less risky by protecting both parties.

Trade Finance plays a vital role in global trade. Nearly 80-90% of traders are using trade finances to conclude their trade deals without investing their cash funds. To meet the growing demand for trade finance and minimize the impact of the global shortage of trade finance. We, Bronze Wing Trading offer a range of Collateral-Free Import Financing options that will enhance your ability to trade globally; improve your cash flow, and make your business more profitable.

Get Import Finance at ZERO Collateral – Apply Now

Import Finance Options Available for Traders

In today’s global trade market, you can find a wide range of import financing options available for traders which can help them to do multiple deals at a time with a min. investment.

For Example: If you have a million-dollar worth of trade deal pending in hand and if you don’t want to invest your cash funds in your upcoming trade deal; then you can make use of Letter of Credit, Import LC, or SBLC. Using these import financing options will help you to import goods without paying your seller in advance.

That is – You can use LC at Sight to import goods; wherein you can pay your global seller after the shipment of goods. Or else, you can also use SBLC, as a payment guarantee; which helps you to import goods from your overseas seller on a credit basis. Further, by providing these options, import finance can help to grow your business without blocking your cash funds or losing any valuable assets.

What is a Letter of Credit?

Letter of Credit or LC MT700 or LC at Sight is a type of import finance option which helps buyers to import goods from their sellers without paying cash in advance. Via LC, the bank ensures the seller that they will receive the payment for the shipped goods, once the terms stated in the issued LC are met.

Get Collateral-Free LC at Sight in 2 Days – Click Here

Accordingly, to receive the payment, the seller needs to provide certain documents as stated in the issued Letter of Credit. Further, this shows that the goods have been shipped to the buyer; as agreed in the contract. Then, if the seller complies with all the terms stated in the issued LC; the bank will release the payment for the supplied goods to the seller.

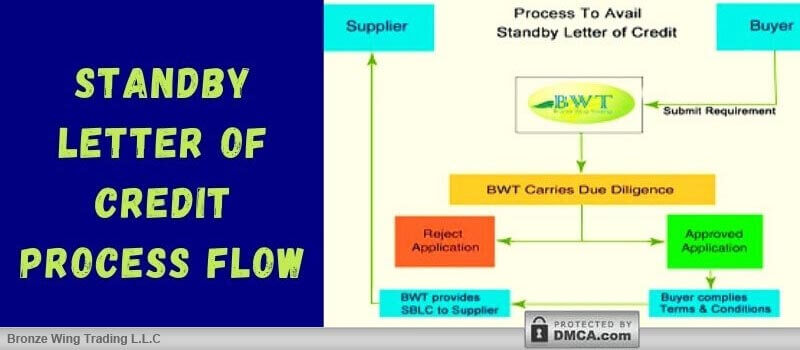

What is a Standby Letter of Credit?

A Standby Letter of Credit is issued by a bank on behalf of its client as a payment guarantee to assure the seller; that the buyer will meet all the financial terms as stated in the contract. Also, it assures that in case of any default in meeting the terms as agreed on the contract; the bank will be liable to fulfill the liabilities on behalf of the buyer.

A standby letter of credit helps do global trade between traders; who don’t know each other and have different laws and regulations in their countries. By giving the required Payment Guarantee, SBLC helps buyers import goods on a credit basis. SBLC is also called payment at last resort, because in the worst scenario; if a buyer goes into bankruptcy or shuts down; then the buyer’s bank will be liable to fulfill its client’s financial terms.

How to Avail Import Finance Facility?

If you’re planning to import goods – whether it can be from Europe, China, or the USA, or anywhere in the part of the world; we can help you with your Trade Finance needs!

Bronze Wing Trading, the trusted Trade Finance Providers in Dubai has our own credit lines with Good Repute Banks. We will extend our facilities on behalf of traders to provide different types of Financial Instruments such as Import LC, SBLC, & Bank Guarantee without cash margin!

Start the process now to get Import Finance Facility by submitting the trade finance requirement to us! Our team will get back to you with a FREE Quote in the next 24hours!

Get DLC MT700 & BG MT760 to Conclude Your Trade Deals!

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]