What is a Performance Bond and How Does It Work?

What is a Performance Bond? Performance bonds are issued by the banks to assure the positive outcome of the project or trade deal. It is mostly used by the contractors in building projects to provide assurance to the project owners. This is to say; that they will comply with the terms of the contract without fail.

Also, this assures that in case, if the contractor fails to act as per the signed contract. Then, the counter party has a right to claim the bonds. In this way, the project owner will cover the losses incurred in the project. For example, it could be – the cost of finding a new contractor to complete the pending work.

Are you going to enter into a contract or trade deal? Is your counter-party demand an assurance in regards to your performances on the project or trade deal? Apply for Performance Bond!

To Get PB MT760 – Submit your Requirement Here!

It is also used by the sellers in commodity trade. Whereas the buyer asked the seller to provide a Bank Guarantee for their performances, as per the signed contract. In case, if the seller fails to comply with the contract terms for the supply of goods; the buyer has a right to claim this Bank Guarantee.

Once the contractor / the seller is bidding for a contract or trade deal; as the first step, they need to provide Bid Bonds to honor the terms of the bid. And once they are awarded the project or supply contract; it will replace by a Performance Guarantee.

Once the contractor or the seller requires advance payment from the project owners or buyers; then they need to provide them a Bank Guarantee to cover their fiscal risk.

How Do Performance Bonds Work?

Performance bonds work in a way to assure the positive outcome of the work done by the contractor or the seller. In case, if there is any default occurs in performing the project or trade deal within the set time limit; then these bonds can be claimed by the project owner or the buyer.

To Get PB MT760 without Blocking Your Own Cash Funds – Contact Us Now!

Further, these Bonds also protect the project owner or the buyer against any default in which the contractor / seller declares bankruptcy; or can’t able to complete the work due to any fiscal issues.

Types of Performance Bonds

On-Demand – As the name suggests, the bank needs to make the payment under the bond; whenever demanded. There is no need to prove that the contractor is in breach of its obligations.

Conditional – This means that the amount is payable only after the occurrence of any unforeseen event. Usually, this includes – delay to complete the works within the set time limit; or a failure to clear the defects after the completion of works.

Key Benefits of Performance Bond

When a project owner wants to protect the investment made in a project, they demand the contractor who won the bid to provide a performance bond before the work begins. Further, this MT760 guarantee will provide the assurance that a contractor will complete the project; as per the terms of the contract.

For Contractors and Sellers:

- Enhances liquidity

- Improves the ability to bid on more tenders

- Opens up more business deals by proving fiscal strength and assuring the positive outcome

For Project Owners and Buyers:

- Gives assurance that the project will complete; even if the contractor or the seller can’t or won’t meet their performance terms

- No need to add additional funds for the completion of works

Avail Performance Guarantee

When you require a Bank Guarantee on your company’s behalf; you normally contact your banker. But to issue such MT760, banks may require a certain percent of the bond value as a cash margin. If you didn’t meet the bank’s demands, then you won’t be able to get the MT760 on your behalf. But, we, the Performance Bond Providers in Dubai are here to assist you to avail the required Bank Guarantee without blocking your cash funds.

Do you require a Bank Guarantee to sign new contracts? Avail Performance Guarantees from us! We provide the required MT760 from rated banks within 48 working hours.

Are You In Need of Performance Bond to Guarantee Your Performances?

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

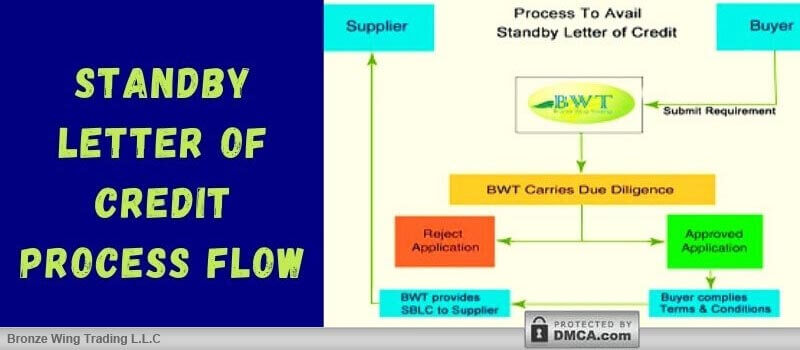

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]

Usually, North China exports industrial goods such as machinery parts, equipment, etc. and East & Central China exports all kinds of commodities & South China export hi-tech products and fashion accessories. From machinery parts to fashion accessories, China stays as the top destination to import goods at the best prices. You want to import goods […]