Different Types of Bank Instruments Available for Traders

Most of the traders are often rely on extra financial sources to conclude their trade deals. To help the traders in need, Federal and other financial sectors have created a range of Bank Instruments; to provide the trade finance support. Mostly, these trade finance tools tailored to satisfy the demands of the traders. The role of trade finance services in global trade is notably important to conclude the deals successfully.

Importance of Bank Instruments

Using a Bank Instrument for business serves as a source of working capital to conclude trade deals. So, no need for traders to utilize their cash funds for their trade deals or contracts. Also, it acts as a guarantee for each party involved in trade deals.

Bank Instruments are the major financing option available to banks to assist the needed traders with their financial tools. But to provide these instruments; banks will mostly require cash margin and some sort of security from traders. But, most of the traders won’t have enough cash funds in their hands; so, they used to lend help from other trade finance providers.

Different Types of Bank Instruments

Documentary LC

It also called a Letter of Credit or LC MT700. Documentary LC acts as a written undertaking to assure the sellers; that they will receive the payment on time; once they ship the goods, as per the agreed contract. Further, on the other side, this assures the buyers that they will receive the goods without any default. To avail LC MT700 from rated banks, contact LC providers in Dubai. We will assist you to avail MT700 without pledging any cash margin from your end.

To Get LC MT700 at ZERO Cash Margin, – Apply Now!

Irrevocable SBLC

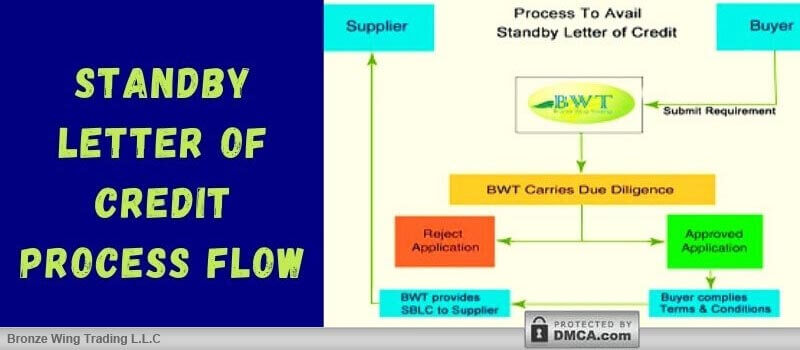

Standby Letter of Credit or SBLC MT760 acts as a guarantee issued by a bank on behalf of its client. This assures the payment to the seller; i.e. in case of the buyer’s default. Further, this acts as a “Payment of Last Resort”. If you’re in need of MT760 to conclude your import and export, contact SBLC Providers in Dubai.

Apply for Standby LC from Rated Banks – Click Here!

MT760 Guarantee

BG MT760 acts as a guarantee issued by a bank to undertake the commitment on behalf of the applicant, in case of default. BGs usually used to facilitate the purchase of bulk trade dealings, heavy equipment, and large building contracts. We, the BG Providers in Dubai help traders to conclude their bulk dealings without blocking their cash funds.

Get BG MT760 Without Blocking Cash Funds – Apply Now!

Payment Bond

Advance Payment Guarantee or Payment Bond is mostly used by contractors to avail advance payments from their project owners; to execute the work on the project. For this, the contractor needs to provide an Advance Payment Bond on their behalf and in favor of their project owners. To avail such MT760 from rated banks, contact us today!

Surety Bond

Performance Bond also called a Surety Bond. This is issued by a bank on behalf of contractors and in favor of project owners. This is used to assure the positive completion of the project. To avail such MT760 Guarantee on your behalf without blocking your cash funds, contact us today!

Bid Security Bond

Also called Tender Bond or Bid Bond. This is issued by a bank on behalf of their client to assure the accuracy of the bid quoted in the bidding process. Also, this bond helps contractors and sellers to win the contest and helps them to avail worthy contracts and trade deals.

Bottom Line

The above mentioned are few of the Bank Instruments which often used by traders and contractors to run their business without facing any fiscal risks.

Are You Looking to Avail Bank Instruments for Your Business?

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]