How to Manage the Trading Risks with Commodity Trade Finance?

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; also, the buyer will make the payment for the supplied goods.

So, what is Trade Finance? Trade Finance covers a wide range of financial instruments used by importers and exporters to support their local and global business transactions. The function of trade finance is to act as a third party to reduce the payment risk and the supply risk; also, it maintains a good rapport between buyers and sellers to have a successful deal conclusion.

Get Trade Finance from Good Repute Banks – Apply Now!

Without trade finance services, businesses involved in overseas transactions may face many risks that can obstruct the smooth transaction of the business. Here we’ve come up with the common risks involved in global deals; also, the tips to manage them.

Importance of Commodity Trade Finance

Risk #1 – Problem:

While dealing with global traders, we don’t have much idea about – what is their financial condition; will they pay for the supplied goods; what happens if they go bankrupt & so on. Signing the contract without having any assurance will lead to significant loss to your business.

Solution: Letter of Credit, the most commonly used in overseas trade, helps buyers and sellers to rest assured; that they will receive the goods and the payment as per the agreed contract. With Import LC, the bank is obliged to disburse the agreed amount to the seller; if and only if the conditions stated in the issued LC are met. Further, this is how DLC MT700 reduces risk #1.

Risk #2 – Problem:

Buyers who import bulk products may face the risk of the quality of goods. They may encounter several queries like – what happens; if they receive damaged or faulty goods which are totally unacceptable.

Solution: Concluding import deals by LC payment helps to reduce the risks associated with the quality of goods. In the issued LC at Sight; it would be clearly mentioned that the buyer cannot deny the payment or reject the products; due to any issues about the quality of goods. But, they can raise complaints about the products delivered from the sellers. So, with the use of a Letter of Credit, importers can reduce risk #2 too.

Risk #3 – Problem:

The currency value fluctuates every day! Import and export businesses that deal with global trade transactions are more vulnerable to face this risk.

Solution: By using an Import LC to conclude your import deal, every item should be written like – the currencies that are used for trade, when payments are to be made and what currency is used when preparing invoices, etc. In this way, we can notably reduce the financial risk associated with this.

Hope this article gives you a clear idea of – the risks involved with global trade; also, the role of trade finance to mitigate the risks. Do you require the right Financial Instrument for your import & export contract? Get help from us today!. We can advise you on the right financial solution. Further, this helps you to conduct your import deals safely and secure from risks.

Get Trade Finance to Import Goods from Overseas Supplier

Recent Blog Post

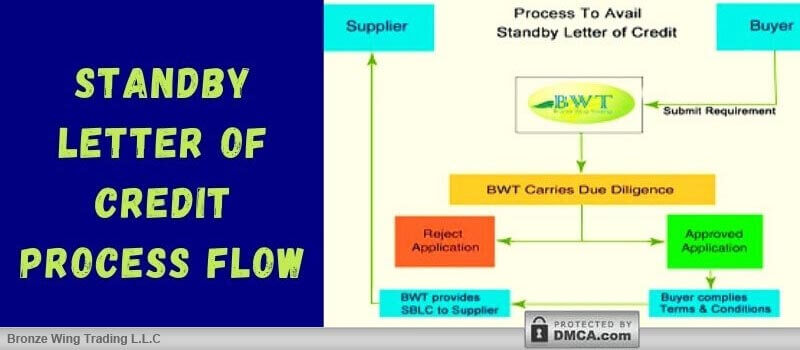

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]

Usually, North China exports industrial goods such as machinery parts, equipment, etc. and East & Central China exports all kinds of commodities & South China export hi-tech products and fashion accessories. From machinery parts to fashion accessories, China stays as the top destination to import goods at the best prices. You want to import goods […]