How to Get Bid Bond – Tender Bond Guarantee for Construction Contracts?

What is a Bid Bond Guarantee?

Bid Bond Guarantee is a written undertaking or assurance issued by a bank on behalf of its client. This acts as a surety that guarantees the project owner that the contractor who enters into the contest will oblige the bidding terms if they win the project. And this will increase their chance of winning the tender. Hence, construction contractors often look for options on How to Get Bid Bond Guarantee.

Moreover, Tender Bond Guarantee ensures the seriousness of the price quoted by the contractor. Also, it assures the project owner that the contractor has the skill to complete the job within the quoted price. Since it gives the utmost assurance; almost all project owners demand a Bank Guarantee from contractors prior to contesting in the bidding process.

Apply for Bid Bond Without Blocking Your Cash Funds – Click Here

Parties Involved

The Principal – The Contractor who requests the bank to avail a guarantee on their behalf; to assure their commitment to undertake the project; as per the quoted price.

The Obligee – The Project Owner who receives the bond from the contractor; who submits the quote for tender.

The Issuing Bank – The Bank that issues the bond on behalf of the contractor to assure the project owner; that the bidder will comply with all the terms without any default.

How to Get Bid Bond Guarantee?

To issue a Bid Bond, banks, and other trade finance sectors will follow a certain set of terms that should be met by the applicant who applies for a bond.

As per the bank norms, you need to block a certain percent of the project value as collateral. On the other hand, some contractors will not be able to comply with this term. Because of this, it seems really hard for contractors to avail the Guarantee from their bank.

Win the Bidding Contest with Bid Bond – Apply Now!

So, to help those contractors, Bronze Wing Trading, the Bank Guarantee Providers in Dubai provides the simple steps for contractors; who wish to avail Bid Bond or Tender Bond from rated banks without a cash margin.

Bid Bond Process

Step 1: At first, contractors submit their request to us by providing the tender copies of the said project.

Step 2: Next, BWT will study their tender copies; and will let them know whether the request has been approved or not. Further, if approved, we will sign a service agreement with the client and ask them to pay the admin charges.

Step 3: After the charges are being paid, BWT will start work on their deal. Further, we will structure their bond with our bank; and then, we will send the draft for their review and approval.

Step 4: The client verifies the draft; if it complies with all the terms; they will acknowledge their approval to us. Then, we will ask them to pay the issuance fee; along with other documents related to the tender.

Step 5: Once they paid the fee and provided the documents; we will instruct our bank to issue the Bond from our bank account. Finally, our bank will issue the bond on behalf of your company and in favor of your counterparty.

Now, with Bid Bonds, contractors will be able to win the tender by assuring their project owners, that they can complete the project within the quoted price and set time frame.

Discuss your MT760 Request with Us – Contact Us Now!

How Much Do Bid Bonds Cost?

The cost varies based on factors; such as the contract terms, the quoted amount, and the tenure. Also, banks demand 10-20% or sometimes 100% of the bond value as a cash margin; to issue the guarantee on your behalf.

But we help contractors to avail the required Bank Guarantee from rated banks without blocking cash funds.

Looking to avail Tender Bond without blocking your cash funds and without tying your working capital? Contact Bronze Wing Trading today! We can help you to get the assurance you need.

Looking to Avail Bid Bond to Contest on a Tender?

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

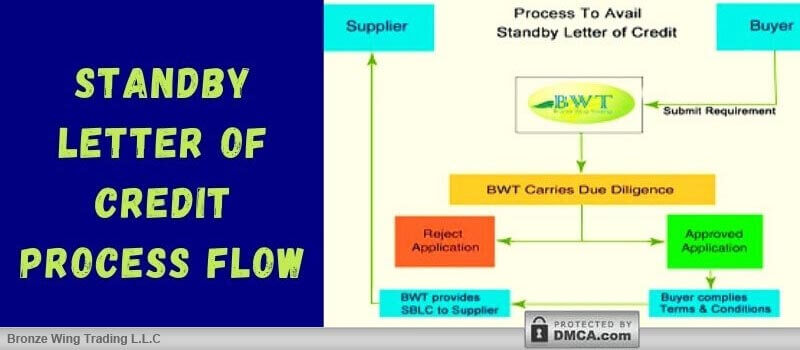

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]

Usually, North China exports industrial goods such as machinery parts, equipment, etc. and East & Central China exports all kinds of commodities & South China export hi-tech products and fashion accessories. From machinery parts to fashion accessories, China stays as the top destination to import goods at the best prices. You want to import goods […]