LC vs SBLC – Which Works Better for International Trade Transaction?

Don’t know whether to choose Letter of Credit or SBLC MT760 for your global trade deal? Do you want to know which Bank instrument works better for global trade deals? This blog answers all your queries! “Is LC MT700 & SBLC MT760 are the same?” This is the most common question we hear from traders when it comes to choosing Bank Instruments. But the answer is “Not at all”. Let us see – What is a Letter of Credit, What is a Standby Letter of Credit & the Difference Between LC vs SBLC.

What is a Letter of Credit?

Letters of Credit is an undertaking issued by a bank on behalf of its client to assure the counterparty that the client will make the payment upon the submission of documents as stated in the issued LC at Sight. The main role played by the Documentary Letter of Credit is to make sure that the buyer pays, and in case of any default by the buyer in making the payment, the bank will pay the seller.

Open Letter of Credit from Good Rated Banks – Apply Now!

What is Standby Letter of Credit – SBLC?

Standby Letter of Credit acts as a payment guarantee which assures the seller that the buyer will make the payment within the due date. It also assures that the bank will be liable to make the payment, in case of the buyer’s default. For instance: if the buyer faces cash flow crunches, bankruptcy, etc., and didn’t make the payment on time, then the seller can claim the SBLC to the buyer’s bank for payment. The bank will settle the payment to the seller, as long as the seller meets the requirements.

Import Goods on Credit Basis Using SBLC – Apply Now!

LC vs SBLC – What Are the Differences?

Both MT700 and MT760 are backed by a bank upon request of the buyer to ensure on-time payments while doing global trade deals. Before making a decision to choose either LC or SBLC as the right financial instrument, here are some key differences which you need to keep in mind:

- The main goal of the LC Payment is to ensure that the transaction goes as planned and the payment will be released after the shipment of goods. So, it’s called a primary method of payment in global trade. On the contrary, Standby LC comes into action, only if there are any unforeseen situations that happen in making the payment. This makes SBLC, the secondary mode of payment.

- By using LC at Sight as a payment term, you need to pay your seller; right after the delivery of goods and the submission of documents to the bank. But, in the case of SBLC, you can pay your seller before the payment due date; whether it can be 30 days or 90 days, or 1 year, based on the term mentioned in the issued SBLC.

- MT700 makes your international trade transaction safe and secure; whereas, SBLC provides security in long-term construction projects; as well as, used as a payment guarantee while dealing with domestic vendors.

How to Apply for LC or SBLC?

If you are going to deal with an international buyer, then you can choose LC at Sight; as it helps to conclude your trade deals in a safe and secure way. On the other hand, if you are dealing with local suppliers and planning to purchase goods on a credit basis; then you can make use of SBLC.

Have you decided whether to use LCs or SBLCs for your trade deal? No matter, whether you want MT700 or MT760, we are here to help you with the issuance process!

We provide – Letter of Credit and SBLCs from rated European Banks at ZERO Collateral in just 2 days! Contact us today!

Get LC or SBLC from European Banks at ZERO Collateral!

Recent Blog Post

While doing overseas business, the question that strikes our mind is – Is our payment safe? Can we trust the buyer and the seller? Would we receive the goods on time? But, with the help of Commodity Trade Finance, we can rest assured that the supplier will deliver the products, as per the signed contract; […]

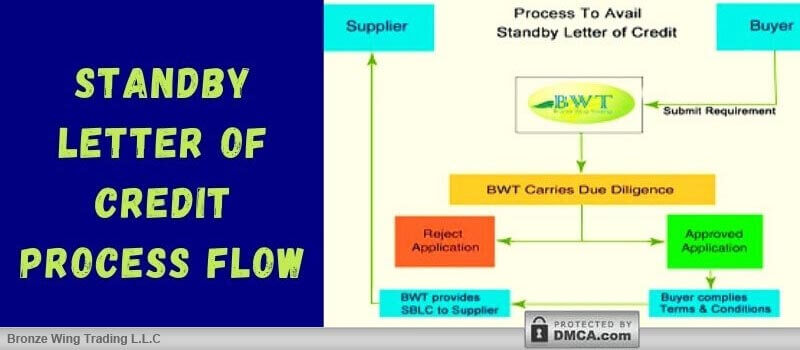

Have you just entered the world of import and export? Looking for the right resources to know – What is Standby LC & its process flow? Read on to understand the Standby Letter of Credit Process Flow and know how you can use SBLC MT760 to create trust between you and your seller. What is […]

A tender Bond is the written undertaking by a bank to protect the developer or buyer in a bidding process. This is used as a security against the risks of the successful bidder if fails to enter into the contract. So, what is tender bond in construction? Let us discuss it in detail! Is your […]

Usually, North China exports industrial goods such as machinery parts, equipment, etc. and East & Central China exports all kinds of commodities & South China export hi-tech products and fashion accessories. From machinery parts to fashion accessories, China stays as the top destination to import goods at the best prices. You want to import goods […]